Table Of Content

- What do house deeds mean?

- What’s The Difference Between A Property Deed Vs. Title?

- Fill Out the Preliminary Change of Ownership Report (PCOR)

- Rocket Mortgage

- Homeless encampments are on the ballot in Arizona. Could California, other states follow?

- Feds say he masterminded an epic California water heist. Some farmers say he’s their Robin Hood

- Buying A Lake House: What You Need To Know And Consider

Let’s take a deeper look at what a house title is; the different types of deeds used in real estate; and related terms including chain of title, title search, title insurance, and title abstract. It is crucial to understand the differences between these concepts before you close on a house. Not only can this understanding better prepare you for the closing table, but it can also ensure you know how to legally protect yourself during the transaction. After all, one thing a house deed and title have in common is that they both directly impact the ownership of the property.

What do house deeds mean?

Area property deed transfers, April 18 - GazetteNET

Area property deed transfers, April 18.

Posted: Wed, 17 Apr 2024 07:00:00 GMT [source]

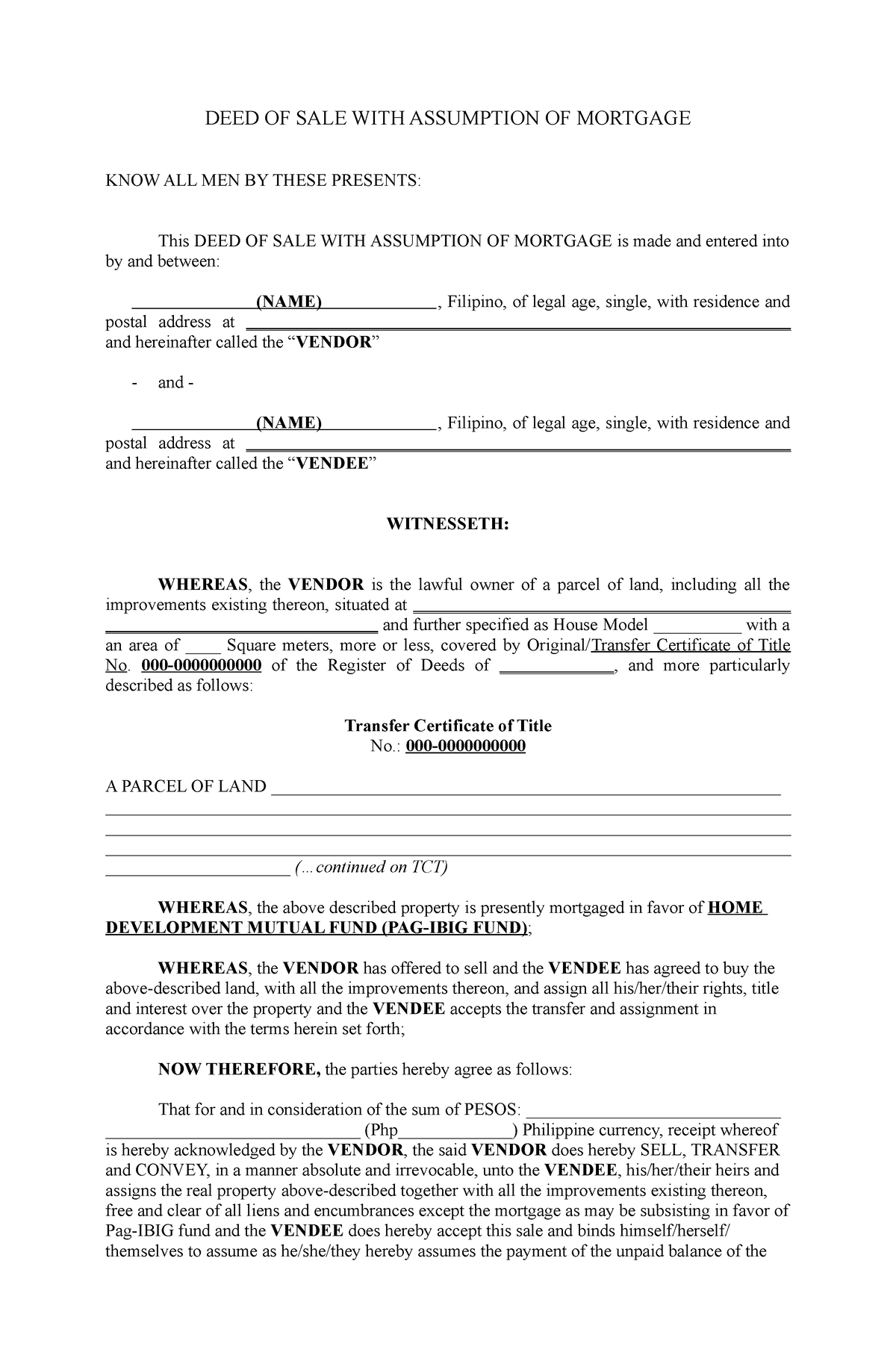

That said, there’s no standard document that is used for all real estate transactions. Deeds are a part of public records, so save yourself some time and trouble by checking online first. In a warranty deed, the grantor promises to pay for any lawsuits or damages due to undisclosed ownership disputes. A grant deed is used when a person who is on the current deed transfers ownership or adds a name to a deed. The grantor(s) promise that they currently own the property and that there are no hidden liens or mortgages. A deed of trust, as noted above, works the same as a mortgage and has a time limit in which the money loaned for the property must be repaid in full.

What’s The Difference Between A Property Deed Vs. Title?

Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards. In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. Last but not least, it’s time to wait to receive the copy of your deed by mail.

Fill Out the Preliminary Change of Ownership Report (PCOR)

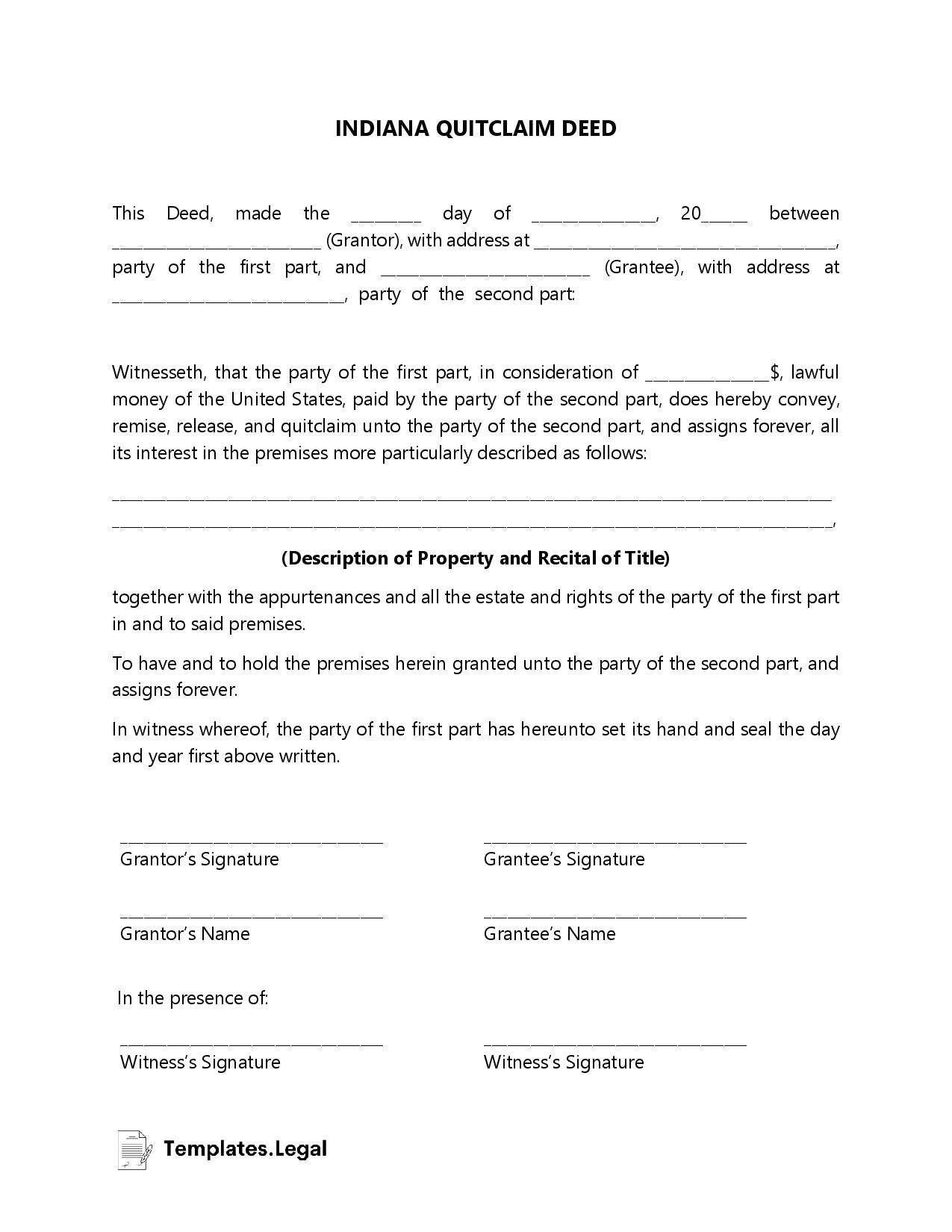

Because of these strong guarantees, a warranty deed is the most commonly used type of deed in the US. Special purpose deeds are frequently used in connection with court proceedings and instances where the deed is from a person acting in some type of official capacity. Most special purpose deeds offer little to no protection to the grantee and are essentially quitclaim deeds. As mentioned above, there are several different types of house deeds that are commonly used. The type of deed used depends on the context of the transaction, and the level of protection being offered. For instance, one type of deed might be used for a traditional home sale, while another type of deed might be used when a court case is involved.

They serve as tangible evidence of property ownership rights and obligations. Special purpose deeds are often used as a part of court proceedings when judgment is involved, or the property deed is coming from a party acting in an official capacity. Typically, we see that special purpose deeds provide minimal protections for the grantee, not dissimilar to quitclaim deeds. When you buy or sell a house, there is a mountain of paperwork involved. One important piece of the puzzle is the property deed, which is an important document that has to do with transferring ownership.

The complexities of real estate ownership

This is not as simple as writing down the property’s mailing address. A legal description includes several pieces of identifying information, such as the lot numbers, physical boundaries, and easements. This kind of deed is particularly useful in establishing co-ownership of property and securing the right of survivorship.

Property deed fraud growing problem in Florida; state offers assistance in detection - FOX 13 Tampa

Property deed fraud growing problem in Florida; state offers assistance in detection.

Posted: Fri, 01 Mar 2024 08:00:00 GMT [source]

These deeds are filed with the local government and are kept as public record. There are many types of property deeds, each with its own unique use – from warranty deeds used to transfer residences in sales to deeds used to transfer inheritance. Your local government maintains property records, including property deeds, typically at the city or county level. In a real estate transaction, a real estate attorney or title company can help you prepare a property deed to transfer ownership. If you need to obtain a copy of a deed for another reason, check your municipality’s clerk, recorder or register of deeds. A general warranty deed is used in many real estate transactions because it’s one of the most secure types of deeds.

Feds say he masterminded an epic California water heist. Some farmers say he’s their Robin Hood

This office does not provide online access to our real estate records or indexes via the internet. In 2021, they used a combination of their personal savings and a first-time home buyer loan to buy their first property together — a multifamily building that they fixed up and rent out. Cuevas’s boss at the University of San Diego connected the couple with a real estate agent, who set them up with a mortgage lender.

Buying A Lake House: What You Need To Know And Consider

House deeds can also be transferred between family members following a slightly different process. This may become necessary when switching ownership between relatives or after a family member has passed away. Different types of deeds can be used in these cases, though a quitclaim deed is the most common. When signing a quitclaim deed, you essentially forfeit your ownership of the property to transfer it to another family member. This transfer is then notarized and recorded with the county recorder’s office.

With a special warranty deed, the grantee assumes some risk in that they would be responsible for any encumbrances that occurred before the grantor took ownership. The grantee is also unable to sue the grantor for not transferring a clear title. The buyer or the lender usually initiates the property deed search in a real estate transaction. The buyer or lender will typically hire a title company or real estate attorney to perform the search and review the results. The cost of the property deed search is usually paid for by the buyer or lender.

However, a deed is a physical, legal document while a property title is conceptual rather than tangible. A deed, on the other hand, transfers the title from the grantor to the grantee. So when you purchase a home you’ll own both the title and the deed. A special warranty deed offers the grantee some protection, but not as much relative to a general warranty deed. The special warranty deed guarantees that there are no title issues during the time period the grantor owned the property. In contrast, a general warranty deed extends this guarantee throughout the property’s history, even through prior owners.

If it turns out that there are claims against the property, the grantee can’t be held liable. If you are entering into a bargain and sale deed as a grantee, it is advisable to conduct a thorough title search and consider obtaining title insurance to mitigate potential risks. A survivorship deed allows co-owners of real estate to automatically transfer a deceased owner’s share to the surviving owner(s). It can help avoid the probate process after the death of a joint property owner, as the property automatically passes to the surviving owner(s) without the need for the involvement of a will or trust. A deed of reconveyance is typically prepared by the trustee and recorded in the public records to provide clear evidence of the release of the lien. In the context of a loan secured by a deed of trust, a deed of reconveyance is used to release the property from the lien once the loan has been fully repaid.

Please keep in mind that each court may have different requirements. If there is only one new owner, and that person is unmarried, title can usually be left blank, although it doesn’t hurt to state something like “a single person” or “a widow” or the like. In a deed in lieu agreement, the lender agrees to accept the property and release the borrower from any other payments of the debt. Deed restrictions, also known as restrictive covenants, are limitations or conditions imposed on the use or development of a property.

The information that we provide is from companies which Quicken Loans and its partners may receive compensation. This compensation may influence the selection, appearance, and order of appearance on this site. The information provided by Quicken Loans does not include all financial services companies or all of their available product and service offerings. Article content appears via license from original author or content owner, including Rocket Mortgage.

If you don’t have this information, there may be additional records search fees. Learn about deed-restricted communities and real estate, what they are and how they work. Let’s take a closer look at what a house deed is, the different types of house deeds and which deed you may encounter when buying a home. Further, deeds become vital if any issues were to come regarding your property title.

Depending on state law, this is either done with a real estate attorney or a title company representative. The history of the transferring of ownership rights is known as the chain of title, and as you sign the deed to become an owner, you become part of that chain. Because deeds are public documents, it is best to present the changes you want to make at your local county recorder’s office. Some options include using a correction deed or recording a new deed. The type of action used is best advised by your county or a real estate attorney for more complex circumstances. Transferring a house deed can sound complicated, but in traditional real estate transactions, it will happen within the closing process.

No comments:

Post a Comment